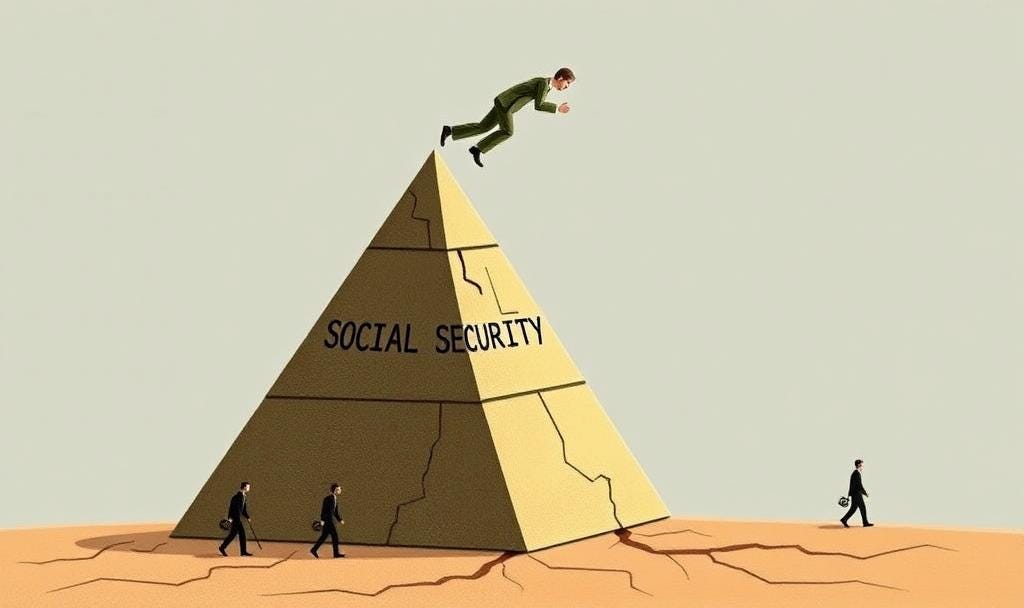

Social Security Is a Lie—and Here's the Math to Prove It

You paid in. You trusted the system. But the numbers don’t work—and by the time you retire, there may be nothing left.

Social Security Is a Lie—and Here's the Math to Prove It

Most Americans believe Social Security will be there when they retire.

They’re wrong.

The system isn’t just broken—it’s mathematically doomed. The government won’t tell you that. Politicians will dodge, deflect, and delay. But numbers don’t lie.

This article isn’t fearmongering. It’s arithmetic. And when you see the math, you’ll understand why Social Security is the biggest financial lie Washington still tells—and why you need to prepare for life without it.

The Promise vs. The Reality

The Promise:

You pay into Social Security your whole working life. When you retire, the government pays you back with interest in the form of monthly benefits.

The Reality:

The government didn’t save your money. It spent it.

What you paid in was used to cover current retirees. Your future benefits depend entirely on younger workers funding the system when it’s your turn. It’s not an investment. It’s a transfer scheme—a political Ponzi scheme—and it’s running out of contributors.

The Core Problem: Demographics and Debt

Here’s the basic math:

When Social Security launched in 1935, there were 42 workers per retiree

Today, there are just over 2.7 workers per retiree

By the 2030s, that number drops closer to 2.3

Now factor in:

The Social Security trust fund will be depleted by 2033

At that point, benefits must be cut by ~23%, unless drastic changes are made

Life expectancy is higher, meaning people draw more benefits over time

Birth rates are lower, meaning fewer workers are paying in

This isn’t speculation—it’s built into the system. It’s already happening.

There Is No “Trust Fund” in Any Real Sense

You’ll hear politicians say “Social Security is fully funded until 2033.”

Let’s translate that:

The “trust fund” is filled with IOUs from the U.S. Treasury

There’s no cash—just promises from one arm of the government to another

Redeeming those IOUs means borrowing more money, raising taxes, or printing dollars

So even if the trust fund lasts until 2033, it’s still funded by you—not saved dollars.

Here’s What That Looks Like

Let’s say you made $60,000/year for most of your life. You and your employer paid 12.4% of that (combined) into Social Security.

That’s $7,440/year, for 40 years = $297,600 paid in.

Sounds decent, right?

Now consider:

That money wasn’t invested—it was spent

You may only receive it back if future workers pay in

If the system cuts benefits by 23%, your $1,500 monthly benefit becomes ~$1,150

Inflation erodes the purchasing power every year

If you live to 85, you’ll likely lose money on Social Security—while being taxed the entire time.

Why No One Will Fix It

To fix Social Security, the government would need to:

Raise the retirement age

Cut current or future benefits

Increase payroll taxes

Means-test payouts (i.e., deny benefits to “wealthier” seniors)

All of these are political suicide.

So instead, they lie:

“We’ll protect Social Security.”

“No one wants to touch your benefits.”

“The trust fund is solvent.”

Translation: They’re stalling—and they’re hoping you don’t notice.

What Happens When It Breaks

When the trust fund runs out and tax revenue can’t keep up:

Automatic benefit cuts hit across the board

Seniors panic, and political pressure explodes

Congress prints money to cover the gap, worsening inflation

Younger generations rebel, having paid into a system that betrayed them

The whole program destabilizes, likely leading to rushed, unfair reforms

This won’t happen decades from now. It happens in 2033—or sooner, if the economy stumbles.

What You Can Do Now

You can’t fix the system, but you can escape its collapse.

Here’s how:

Don’t count on Social Security in your retirement plan

Build independent income streams and savings

Diversify into real assets that hold value

Prepare for higher taxes and inflation

Wake up friends and family before the panic hits

Final Word

Social Security is not a retirement plan. It’s a government promise—one backed by unsustainable math and fading political will.

The lie isn’t just that it’s “secure.”

The lie is that you’ll be taken care of.

You won’t. Not by this system.

So start building your own.